Renters Insurance in and around Aubrey

Aubrey renters, State Farm has insurance for you, too

Rent wisely with insurance from State Farm

Would you like to create a personalized renters quote?

- Aubrey

- Cross Roads

- Little Elm

- Frisco

- Prosper

- McKinney

- Holly Hock

- Windsong Ranch

- Denton County

- Denton

- Collin County

- Savannah

- Union Park

- Providence Village

- Oak Point

- Linden Hills

- Creekside

- Paloma Creek

- Braswell High

- Estates at Rockhill

- Panther Creek HS

- PGA of America

- Somerset Park

- Silverado

There’s No Place Like Home

There's a lot to think about when it comes to renting a home - location, number of bedrooms, parking options, townhome or condo? And on top of all that, insurance. State Farm can help you make insurance decisions easy.

Aubrey renters, State Farm has insurance for you, too

Rent wisely with insurance from State Farm

Open The Door To Renters Insurance With State Farm

None of us can see what we will encounter in the future. That’s why it makes good sense to plan for the unexpected with a State Farm renters policy. Renters insurance protects the things inside the place you call home with coverage. In the event of vandalism or a theft, some of your belongings may have damage. If you don't have enough coverage, the cost of replacing your items could fall on you. It's scary to think that in one moment, you could risk losing all your possessions. Despite all that could go wrong, State Farm Agent Tommy Rosales is ready to help.Tommy Rosales can help offer options for the level of coverage you have in mind. You can even include protection for valuables beyond the walls of your home. For example, if your personal property is damaged by a fire, a pipe suddenly bursts in the unit above you and damages your furniture or your car is stolen with your computer inside it, Agent Tommy Rosales can be there to help you submit your claim and help your life go right again.

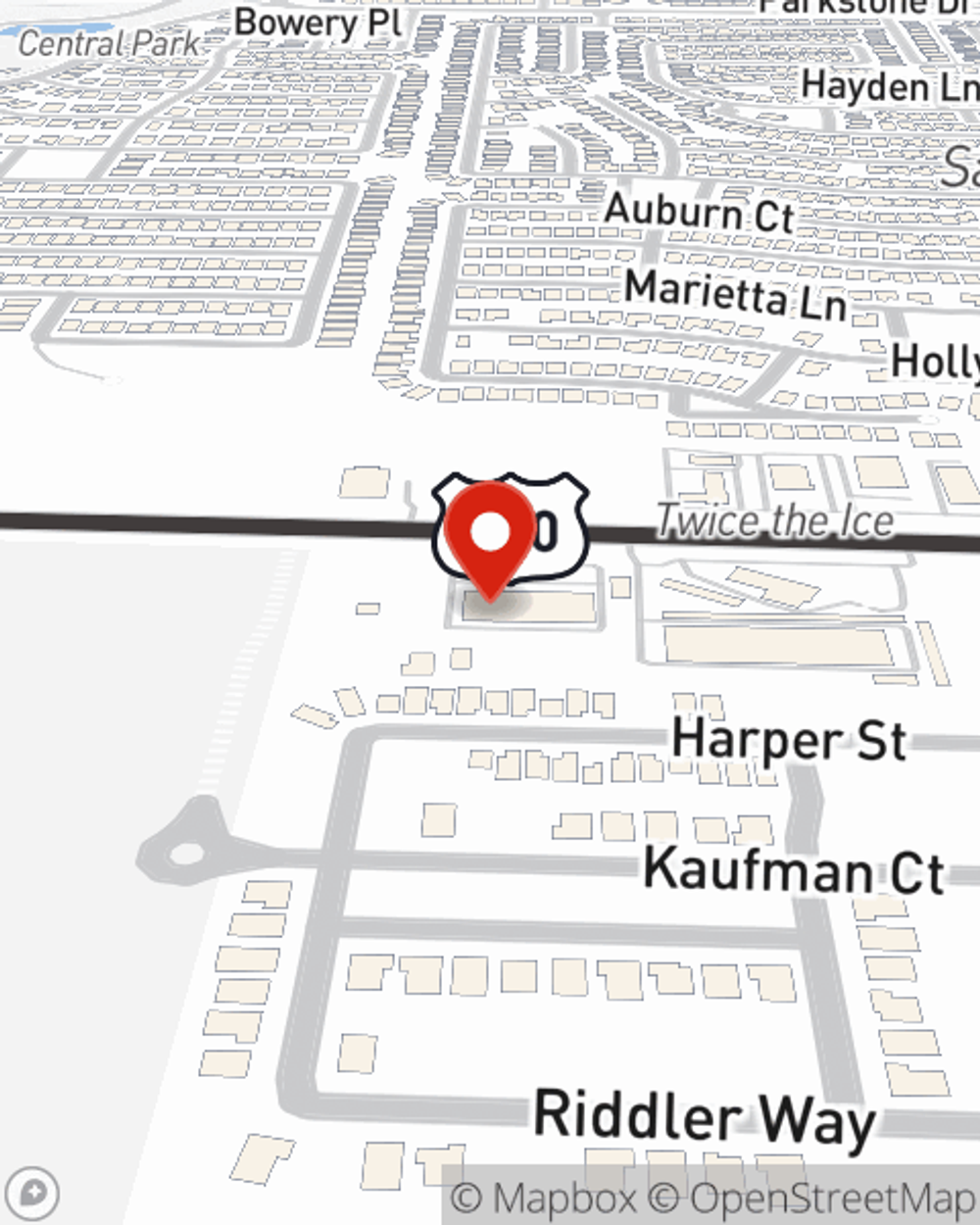

Reach out to State Farm Agent Tommy Rosales today to see how a State Farm policy can protect your possessions here in Aubrey, TX.

Have More Questions About Renters Insurance?

Call Tommy at (940) 387-4512 or visit our FAQ page.

Simple Insights®

Getting rid of dust in your house

Getting rid of dust in your house

A dusty home can make asthma and allergy sufferers uncomfortable. Discover tips to help reduce or eliminate the amount of dust in your house.

Rental trends: What landlords and tenants need to know

Rental trends: What landlords and tenants need to know

Understanding the current trends surrounding the rental industry will help both landlords and tenants understand how to navigate this changing landscape.

Tommy Rosales

State Farm® Insurance AgentSimple Insights®

Getting rid of dust in your house

Getting rid of dust in your house

A dusty home can make asthma and allergy sufferers uncomfortable. Discover tips to help reduce or eliminate the amount of dust in your house.

Rental trends: What landlords and tenants need to know

Rental trends: What landlords and tenants need to know

Understanding the current trends surrounding the rental industry will help both landlords and tenants understand how to navigate this changing landscape.